Professional Appraisal / Umpire Services in Tampa Bay

Every Conflict Has a Path to Resolution

What happens when your insurer’s numbers don’t match your reality—and every day that passes feels like another setback?

In Tampa Bay, property damage disputes are more than paperwork. They represent sleepless nights, mounting bills, and the fear of being left without the resources to rebuild.

When policyholders and insurers can’t agree on property loss value, an impartial appraisal process offers a binding, faster, and more efficient solution than court proceedings.

Each side picks a qualified appraiser—if they disagree, an umpire resolves the difference, with the award accepted by any two of the three panel members. This process removes endless conflict and restores balance, offering clarity when emotions run high and costs climb.

At Ward Mediation, we know the weight of uncertainty. That’s why we step in with integrity, fairness, and local expertise—turning frustration into resolution and helping you move forward with confidence, not compromise.

Take control of your insurance dispute today. Ward Mediation delivers fast, binding solutions for Tampa Bay families and businesses—helping you move forward without compromise.

What is an Appraisal / Umpire in Florida Insurance Disputes?

When disaster strikes, arguments over numbers often hurt more than the storm itself. That’s when the appraisal clause becomes your lifeline.

In Florida, most property insurance policies contain an appraisal clause—a voluntary, contract-based pathway designed to end disputes without the burden of litigation.

It is triggered when the insurer and the policyholder cannot agree on the amount of the loss after a claim.

Instead of heading straight into costly court proceedings, the clause allows each side to appoint an independent appraiser.

These appraisers review the damage, calculate their own valuations, and attempt to reach a mutually agreed-upon valuation. If they succeed, the matter ends quickly and fairly.

But here’s where it gets powerful: when appraisers disagree, they must select an umpire. This neutral third party steps in to review the differences and cast the deciding vote. Florida’s model sets strict timelines—20 days to name appraisers, 15 days to agree on an umpire.

If the appraisers can’t, the courts may appoint one. Once any two of the three panel members (appraiser, appraiser, umpire) agree on a figure, that amount becomes the binding settlement under Florida law. (Florida Statutes §627.70151)

This clause isn’t fine print—it’s the difference between months of uncertainty and a structured path to closure.

For Tampa Bay families patching roofs and businesses facing downtime, it’s often the fastest way back to stability.

Roles of Appraisers vs. Umpire

Think of the appraisal process as a three-part panel of fairness: two appraisers and one umpire.

- Appraisers: Each party—either the policyholder or the insurer—chooses an appraiser. These professionals are expected to be competent, impartial, and independent. Their role is not advocacy; it’s evaluation. They analyze repair estimates, local construction costs, and the extent of damage.

- Umpire: If appraisers can’t align on a figure, the umpire becomes the tiebreaker. This role is vital. The umpire reviews both appraisers’ findings, may conduct site inspections, and ultimately casts the deciding vote.

The process ensures that no single side controls the outcome. It’s a built-in safeguard: two voices must agree, guaranteeing balance.

As the American College of Coverage Counsel notes, this three-member panel protects policyholders from lowball estimates and insurers from inflated claims—restoring fairness when negotiations stall.

When an Umpire Is Necessary

The umpire doesn’t always appear. In fact, many disputes are resolved when the two appraisers reach a consensus. But when valuations diverge, and each side digs in, the umpire becomes the decisive authority.

Here’s why it matters: once an umpire issues an opinion, and at least one appraiser agrees, the award is final.

Florida courts treat this decision as binding, unless it is proven to be tainted by fraud or collusion. That means no second-guessing, no endless appeals—the uncertainty ends.

For Tampa Bay homeowners facing hurricane losses or businesses disputing complex commercial claims, this finality is priceless.

It transforms months of anxiety into closure, allowing life—and operations—to move forward.

How the Appraisal / Umpire Process Works in Tampa Bay

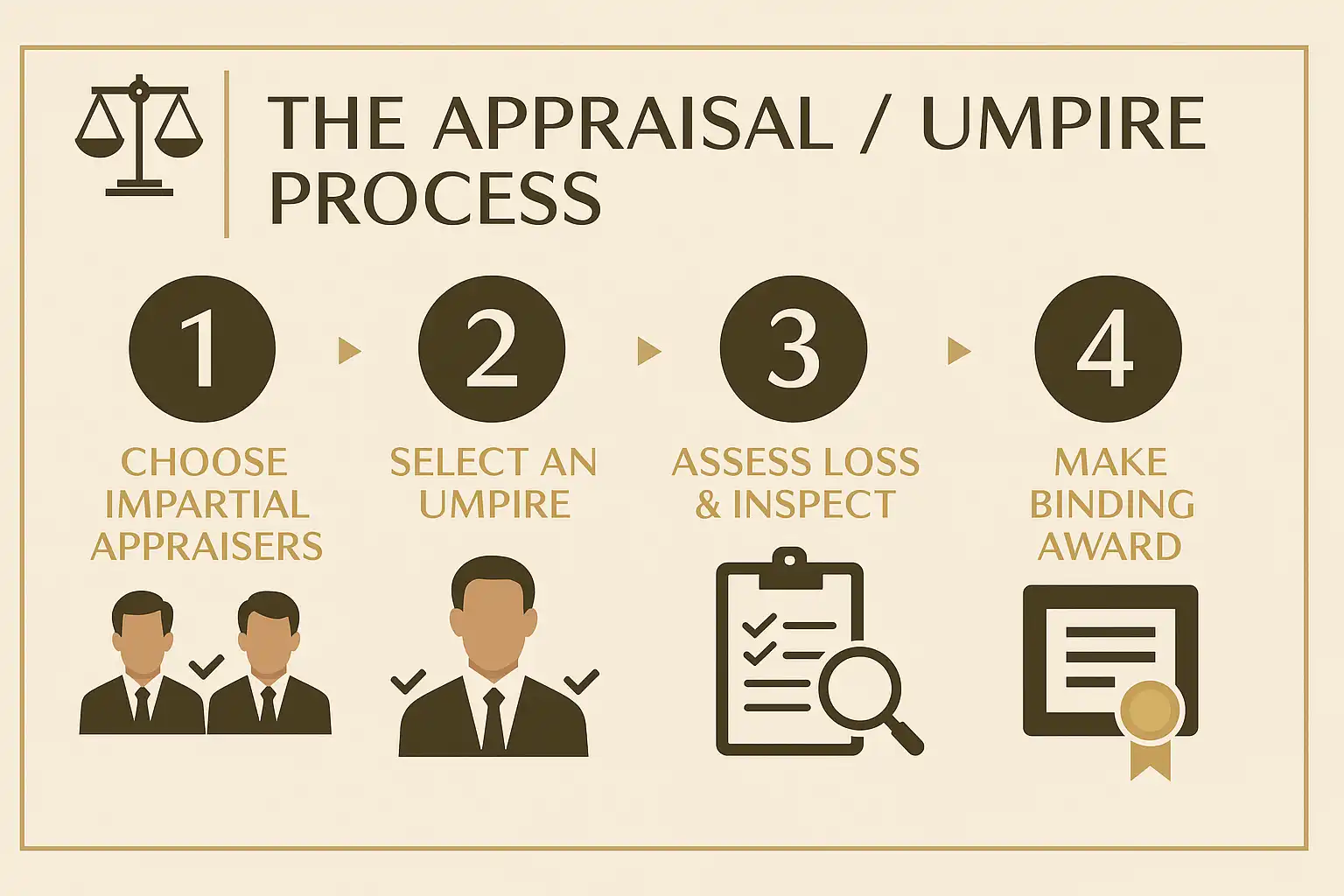

It may sound complex, but the process is straightforward. Here’s what really happens, step by step.

Step 1 – Choosing Impartial Appraisers

The clock starts ticking as soon as the appraisal clause is invoked. Both sides have about 20 days to select their appraisers. These professionals must be impartial, qualified, and free from conflicts of interest.

Their job isn’t to argue—it’s to evaluate. They review property conditions, damage estimates, contractor bids, and replacement costs. In Florida, where hurricane damage can spike material and labor prices overnight, having appraisers who understand local construction markets is critical.

This first step is where credibility is built. By ensuring each side chooses someone impartial, the process sets a foundation for fairness.

Step 2 – Selecting a Umpire

Once appraisers are appointed, they must agree on an umpire—usually within 15 days. This person must be truly impartial: no recent business, family, or employment ties with either side. If they can’t agree, a Florida court steps in to appoint one (F.S. §627.70151).

This safeguard ensures there’s always a path forward. No stalemates. No endless delays. Someone neutral will always be available to settle the dispute.

Step 3 – Assessing Loss & Conducting Inspections

Now, the real work begins. Appraisers visit the property, inspect the damage, review documentation, and sometimes bring in experts, such as engineers, contractors, or valuation specialists.

Each appraiser prepares an independent estimate. If their valuations align, the award is quickly signed, and the process ends. But if differences remain, those findings are sent to the umpire.

The umpire may personally inspect the property, review the evidence, and weigh both sides carefully before making a decision.

This stage transforms raw data into actionable resolution. It’s where evidence, expertise, and impartial review converge.

Step 4 – Binding Award by Panel Majority

The final step is simple but powerful: any two of the three panel members must agree. That majority agreement becomes the official award. Once signed, it becomes a legally binding and enforceable document in Florida courts.

The only exceptions? Cases involving fraud, collusion, or misconduct. Otherwise, the award stands as the final word (Property Insurance Coverage Law Blog).

This is why the process is so effective. Unlike litigation, which can drag for years, appraisal typically resolves within 90–120 days, compared to 1.5 to 4 years for lawsuits.

For policyholders desperate to repair storm-damaged homes or reopen their businesses, that speed isn’t just convenient—it’s lifesaving.

Tired of endless back-and-forth with your insurance company? Get a neutral, binding decision in weeks—not years—with Ward Mediation’s trusted Tampa Bay services.

Benefits of Appraisal / Umpire Services

When stress mounts and time slips away, you deserve a resolution that brings certainty—not more questions.

Final & Binding Resolution — Legal Force You Can Trust

Once two of the three panel members (either both appraisers or one appraiser plus the umpire) endorse a figure, that number becomes the binding settlement.

Florida courts uphold these awards unless there’s clear misconduct—like fraud or misfeasance.

The rigor of this process brings security and finality, so you can stop fighting and start rebuilding.

Faster & Cost-Effective Resolution — More Time, Less Cost

Litigation often drags on for 1.5 to 4 years, eating away at finances and peace of mind. Appraisal, on the other hand, typically resolves in just 90–120 days.

Both parties each pay their own appraiser, sharing the such-upon umpire cost—resulting in a faster and fairer outcome.

Plus, Florida’s recent regulatory reforms continue to streamline the claims process.

Balanced & Confidential Process — Preserve Dignity Amid Disputes

Legal battles are public, expensive, and emotionally draining. The appraisal process, by contrast, remains confidential, structured, and respectful.

Everyone presents evidence calmly and professionally. The focus stays on fair valuation—not accusations or public spectacle—allowing relationships (and reputations) to remain intact.

Every dispute has a solution—and you deserve one that’s fair. Call Ward Mediation now to schedule your Tampa Bay appraisal and regain your peace of mind.

Legal Safeguards & Umpire Impartiality in Florida

Fairness isn’t optional. It’s the foundation—and Florida law enforces it with clarity.

Grounds for Disqualification — Ensuring Neutral Experts

Florida statute clearly protects against conflicts. An umpire must be impartial; if there’s a familial tie, past representation, or an employment link within the past five years—any of which may bias judgment—the umpire can be disqualified. (Florida Statute §627.70151)

Enforceability of Awards — Courts Respect the Process

Once properly completed, appraisal awards stand strong in Florida’s legal system. Courts will uphold them, unless clear evidence shows fraud or misconduct.

That enforcement ensures your appraisal outcome is not just a suggestion—it’s your settlement.

Why Tampa Bay Property Owners & Insurers Should Use Umpire Services

Florida’s risks aren’t theoretical—they’re lived realities. Tampa Bay knows this better than most.

Exposure to Hurricanes, Fire, Floods, and Rapid Property Growth

From hurricanes sweeping across the Gulf to rising flood risks and dense urban expansion, Tampa Bay faces a perfect storm of challenges.

In 2022 alone, Hurricane Ian caused an estimated $109 billion in damages statewide, with thousands of disputes tied to insurance payouts (FEMA, 2023).

Local property growth only complicates matters: rapid development in Hillsborough, Pinellas, and Pasco counties means higher property values and greater stakes when damage occurs.

With so much on the line, precise and impartial valuation isn’t just helpful—it’s essential.

State-Specific Legal Precision — Florida’s Framework for Compliance

Florida law adds an extra layer of complexity to insurance disputes. From statutory timeframes for appointing appraisers to conflict-of-interest rules for umpires, every step is governed by strict regulations.

Florida Statute §627.70151 requires impartiality and allows disqualification if neutrality is compromised. Understanding these procedural rules ensures cases are compliant—and awards are upheld in court.

Tailored Service Across Tampa Bay — Hillsborough, Pinellas, and Pasco Counties

Disputes don’t happen in a vacuum. Each county carries its own risk profile and property market trends.

Hillsborough’s mix of urban and suburban development, Pinellas’s coastal exposure, and Pasco’s rapid expansion all create unique insurance challenges.

By tailoring services to these local realities, Tampa Bay residents and insurers alike gain an umpire process that reflects the region’s distinct risks and values.

Why Choose Ward Mediation for Appraisal / Umpire Services?

When you’re fighting for fairness, experience and trust matter as much as process.

Certified & Ethical Professionals — Statutory Compliance at Every Step

Ward Mediation operates with strict adherence to Florida’s laws on impartiality. Under §627.70151, our commitment is clear: no hidden conflicts, no bias, only neutral, professional evaluation. Every decision is guided by the statute and by an ethical duty to fairness.

Strong Track Record & Local Trust — Resolution You Can Count On

Ward Mediation isn’t a distant name—it’s a trusted presence within Tampa Bay. With a proven record of resolving complex claims swiftly and fairly, we’ve built a reputation for efficiency, impartiality, and community trust.

For homeowners facing storm damage or insurers navigating complex claims, our role is straightforward: restore clarity, break through stalemates, and deliver outcomes that stand up in court and in practice.

From Hillsborough to Pinellas to Pasco, Ward Mediation is trusted across Tampa Bay. Contact us now and move forward with confidence, not conflict.

Frequently Asked Questions

How long does the insurance appraisal process take in Florida?

Most appraisals conclude within 90–120 days, compared to litigation, which may last several years. The timeline includes appointing appraisers, selecting an umpire, conducting inspections, and issuing the final award.

Is an umpire’s decision final and binding in Florida?

Yes. Once any two panel members sign the award, it is final and enforceable in Florida courts. Challenges are rare and usually limited to fraud or misconduct.

Who pays for the appraisal and umpire services?

Each party pays its own appraiser, and both split the umpire’s fee. This cost-sharing model keeps expenses predictable and far lower than litigation costs.

What happens if appraisers cannot agree on an umpire?

If the two appraisers fail to agree within the set timeframe, a Florida court can appoint an umpire. This ensures the process cannot be stalled by disagreement.

Can an appraisal award be overturned?

Appraisal awards are almost always final. Courts may overturn them only if there’s evidence of fraud, collusion, or misconduct. Otherwise, awards remain enforceable.

Do I need an attorney to go through the appraisal?

Not necessarily. Many policyholders complete the appraisal process without attorneys. However, legal guidance may be helpful for complex claims or disputes involving high-value losses.

When should I request an appraisal under my insurance policy?

You should consider invoking appraisal when you and your insurer disagree on the value of damages—not whether coverage applies, but specifically on how much the loss is worth.

How is an umpire selected in a Florida appraisal?

The two appraisers must agree on an impartial umpire within about 15 days. If they cannot, the courts appoint one to keep the process moving forward.

What types of claims use the appraisal process?

Appraisal is common in property damage claims, including those resulting from hurricanes, floods, fires, and wind losses. It is designed to resolve valuation disputes, not coverage.

Why is appraisal faster than litigation?

Appraisal avoids lengthy hearings, discovery, and court delays. The process focuses solely on valuation, enabling parties to reach closure in months rather than years.